LTC Price Prediction: Will Litecoin Reach $200 Amid ETF Optimism?

#LTC

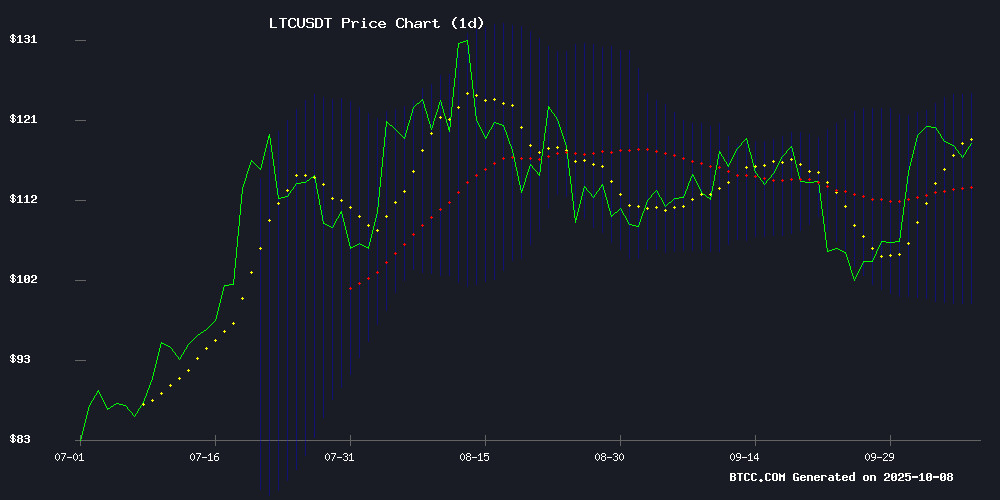

- LTC trading above 20-day MA at $111.96 indicates bullish technical positioning

- Spot Litecoin ETF approvals nearing, potentially driving institutional demand

- Current price of $118.47 requires 69% gain to reach $200 target

LTC Price Prediction

LTC Technical Analysis

Litecoin is currently trading at $118.47, above its 20-day moving average of $111.96, indicating potential bullish momentum. The MACD reading of -2.65 suggests some short-term weakness, though the price remains within the Bollinger Band range of $99.47 to $124.46. According to BTCC financial analyst Emma, 'The current technical setup shows LTC holding above key support levels, with the upper Bollinger Band at $124.46 representing the next resistance point.'

Market Sentiment and Regulatory Developments

Positive regulatory developments are supporting Litecoin's market sentiment, with Canary Capital's spot Litecoin ETF nearing SEC approval. BTCC financial analyst Emma notes, 'The potential launch of Litecoin ETFs represents a significant milestone for institutional adoption, though market volatility remains a concern in the short term.' The broader crypto-equity index gains are providing additional tailwinds for digital assets.

Factors Influencing LTC's Price

S&P Global's Crypto-Equity Index Gains Traction as Tokenized ETFs Lag

S&P Global's newly launched S&P Digital Markets 50 Index is poised to outpace tokenized ETFs in adoption, combining 15 cryptocurrencies and 35 crypto-exposed equities. The hybrid benchmark offers both traditional exchange access and blockchain-based exposure through Dinari's tokenization platform.

Tokenized assets have surged past $1B in market value, with transfer volumes doubling monthly. Nasdaq's recent SEC petition for tokenized equity offerings underscores institutional demand for blockchain-integrated capital markets. "Digital assets are becoming Core to investment strategies—whether for diversification or innovation," noted Cameron Drinkwater of S&P Dow Jones Indices.

Monthly Dividend REITs Offer Paycheck-Like Income Streams

Retirees seeking consistent cash FLOW are turning to real estate investment trusts with monthly payouts. Unlike typical quarterly distributions, these REITs—Realty Income (O), EPR Properties (EPR), and LTC Properties (LTC)—function as near-paycheck replacements.

Realty Income dominates the net lease sector with 15,600 properties, offering a 5.3% yield that dwarfs the S&P 500's 1.2%. Its diversified portfolio across property types and regions provides stability, complemented by a 30-year dividend growth streak that appeals to income-focused investors.

Litecoin ETF Nears Launch Amid Market Volatility

Litecoin's potential ETF approval by the SEC in 2025 could mark a pivotal moment for institutional adoption. With a proposed 0.95% management fee—higher than Bitcoin ETFs but typical for nascent markets—analysts speculate on its impact. "If there’s flows, other issuers will no doubt come and terrordome that sht with cheaper products," remarked Bloomberg's Eric Balchunas.

The filing details, including ticker symbols LTCC (Litecoin) and HBR (Hedera), suggest final-stage preparations. However, the ongoing US government shutdown introduces uncertainty into the SEC's review timeline. Market Optimism persists despite Litecoin's recent price volatility, as traders anticipate ETF-driven liquidity.

Canary Files S-1 Amendments for Spot Litecoin and Hedera ETFs, Nearing Launch

Canary Capital has submitted amended S-1 filings for spot Litecoin (LTC) and Hedera (HBAR) exchange-traded funds, signaling a final regulatory step before potential trading launches. The move suggests imminent approval, though a possible U.S. government shutdown could introduce delays.

The filings mark growing institutional interest in altcoin investment vehicles beyond Bitcoin and ethereum ETFs. Litecoin, often referred to as 'digital silver' to Bitcoin's gold, and Hedera's enterprise-focused distributed ledger technology now stand at the threshold of mainstream financial product integration.

Canary Capital’s HBAR and Litecoin ETFs Near SEC Approval

Canary Capital's amended registration for its HBAR ETF (ticker: HBR) and Litecoin ETF (ticker: LTCC) signals imminent SEC approval, with both funds carrying a 0.95% sponsor fee. Analysts note the filings represent the final procedural step before launch—Bloomberg's Eric Balchunas emphasized the significance of these details in a social media post.

The fee structure, though higher than bitcoin ETFs, reflects the niche positioning of these products in a competitive market. Blockforce Capital's Eric Ervin acknowledges the premium as justifiable for novel crypto exposure vehicles. Regulatory momentum builds as HBAR, Solana, and XRP ETFs clear technical hurdles with Depository Trust listings, while Nasdaq's FORM 19b-4 submission advances the process.

Will LTC Price Hit 200?

Based on current technical indicators and market developments, reaching $200 in the near term appears challenging but not impossible. LTC would need to gain approximately 69% from current levels of $118.47. The technical analysis shows resistance at $124.46 (upper Bollinger Band), with multiple resistance levels above that. However, the potential approval of spot Litecoin ETFs could provide significant momentum.

| Current Price | Target Price | Required Gain | Key Resistance |

|---|---|---|---|

| $118.47 | $200.00 | 68.8% | $124.46 |

BTCC financial analyst Emma states, 'While the $200 target is ambitious, the combination of technical positioning and positive regulatory developments creates a favorable environment for gradual upward movement. Investors should monitor ETF approval timelines and broader market sentiment.'